My car insurance plan is up for renewal and every six months they send me my new cards as well as the outline of how much I will be paying each month. to my surprise, my rates went up. Even though (knock on wood), I have a perfect driving record. No tickets, no accidents in over 15 years, etc. So, when I saw that they raised my monthly premium, I was a little annoyed. I text my mom while I was waiting in line at Trader Joe’s and asked her why insurance companies do such a thing. and that’s when I came to realize that I am probably not the only person who has had this question. Today, we are going to go over the many reasons why insurance companies raise their rates.

Auto Accident Attorney | Why Insurance Rates Go Up

I have to tell you, even though I work for an auto accident attorney, I was still surprised that my insurance rates went up. Now, don’t get me wrong, they didn’t increase by much. Maybe $7 or $8 more than I am used to. However, it didn’t make sense to me. Why do they keep going up when I have a spotless driving record? Doing some research, it makes sense. Even though, it’s also not fair. Here are some common reasons why the insurance companies raise our premiums.

- Recent changes

- This can be due to a new car or moving to a new address;

- The insurance company decided to raise them;

- Claim funds are low;

- Your credit has drastically changed

Some of these things seem incredibly unfair. Especially if you are a good driver and you are used to paying a specific amount each month, like I am. I thought that since I am a safe driver and not a new driver, that my insurance rates would either stay the same or even drop. However, in doing the research, that it not the case for most safe drivers like myself.

We have to think of it this way, an insurance company is a business. Meaning, that they provide you a service. Even if you are the safest driver on the road, the insurance company is likely to have at least one driver (perhaps more) who is not. That can mean that they have been involved in one accident or more and the insurance company paid out several claims to injured parties. Unfortunately, that means higher rates for the rest of their customers. This is to offset the losses they have accrued.

That being said, insurance companies can revise their rates at any time. and usually that revision in rates is a slight increase.

Rates Go Up When Claim Reserves Are Low

Even working for an auto accident attorney, I had no idea that insurance companies are required to keep a specific amount of money in a reserve. It makes sense; this is not unlike a savings account. Insurance companies like to have a certain amount of money in reserve just in case they are required to pay out unexpected claims. and some insurance companies will raise their rates because they need to have more money in this reserve than another insurance company.

This can actually be beneficial to you as their insured. What the insurance company does is raise their rates if you live in an area where they are taking on an additional risk. Let’s give the example of an area where a lot of road construction needs to be done and isn’t slated to be completed until 2021. This means that they are taking on the additional risk of insuring you because you are more likely to either get into an accident or for something to happen to your car.

Distracted Driving | One Big Cause Of Rate Increase

This should come as no surprise. Especially if you live in Southern California. Distracted driving is on the rise. on my commutes to work and even when I’m driving around town on the weekends, I see so many people on their cellphones. Whether they’re talking, texting, finding a song, etc. and believe it or not, there are times I see people applying makeup quite often when they are driving.

With all of that being said, the insurance companies are taking notice of accidents that are caused by distractions. Therefore, they are increasing their rates for those who they consider to be “at risk” drivers. Which doesn’t seem all that fair, however, it does make sense.

More People On The Road

I’m sure most people in Orange County are noticing that the freeways are packed more and more every day. I do, at least. and since accidents are the driving force (no pun intended) for the rise in insurance rates, that means that in more populated areas, the more likely you will see a steady increase in your rates.

Uninsured/Underinsured Drivers

Every driver in California is required by law to carry car insurance. However, there are some who do not. Furthermore, there are drivers on the road that may not carry enough insurance to cover an accident. Dealing with uninsured or underinsured claims after an accident means that the insurance company loses more money than is in reserve for their claims. Our car accident lawyer did the research and it should be noted that the average cost of an uninsured motorist claim is roughly $20,000.

Car Accident Lawyer | Don’t Worry

Yes, insurance rates are always going to increase. You can take the chance and speak to an agent at your insurance company when you notice an increase. They may be able to do something for you. Though, you should not have to pay (literally) for other people’s mistakes; we do still need to look at everything from a business standpoint. Yes, insurance companies make a lot of money. However, they also lose a lot of money when a claim is filed and they have to pay out on seven or eight figure settlements.

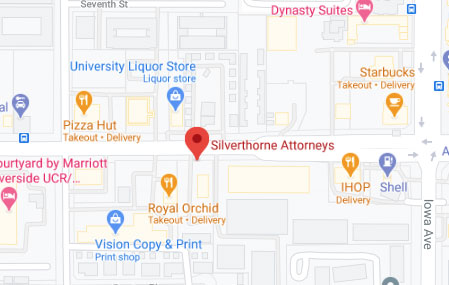

If you have been injured in an accident, contact us to discuss your case. You should never have to deal with the insurance companies on your own. as we have said, the insurance company is here to make money. Even if that means lowballing or denying your car accident claim. the auto accident attorneys in our office have years of experience dealing with insurance adjusters and are very aware of how they work. We will not be swayed by their bullying tactics. Contact an auto accident attorney at Silverthorne Attorneys today. Consultations with one of our car accident lawyers are free!